- #BLUE SHIELD TIMELY FILING LIMIT 2020 CODE#

- #BLUE SHIELD TIMELY FILING LIMIT 2020 PLUS#

- #BLUE SHIELD TIMELY FILING LIMIT 2020 PROFESSIONAL#

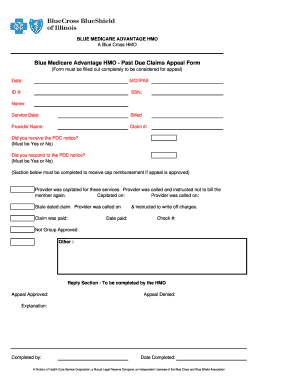

Please make sure you select the appropriate form to address your specific need. Three forms are also available to aid providers in preparing an appeal request. The following documentation provides guidance regarding the process for appeals.

#BLUE SHIELD TIMELY FILING LIMIT 2020 PROFESSIONAL#

For more information about Medicare including a complete listing of plans available in your service area, please contact the Medicare program at 1-800-MEDICARE (TTY users should call 1-87) or visit. Currently, Anthem requires physicians to submit all professional claims for commercial and Medicare Advantage plans within 365 days of the date of service.

#BLUE SHIELD TIMELY FILING LIMIT 2020 CODE#

When billing a bilateral CPT code, verify that the code is inherently bilateral, meaning providers need not add any additional modifier.Confirm that the age of the member matches with the diagnosis code billed on the claim.Check the coding crosswalk to confirm that the codes you are submitting are compatible with each other before billing.Dental providers, may reference Clinical Corner – Dental and behavioral health providers may reference the Beacon Provider Handbook. *Other claim types, such as dental and behavioral health, may have different claims timely filing requirements. If you need to speak with someone, call Provider Services at 86.our hours are 8 a.m. Medicare: claims must be received within 365 days, post-date-of-service.įor more information, visit the Claims Corner section of our Provider website, Providers | Claims Corner.

#BLUE SHIELD TIMELY FILING LIMIT 2020 PLUS#

Medicaid, and Child Health Plus (CHPlus): claims must be received within 15 months, post-date-of-service.Commercial products: claims must be received within 18 months, post-date-of-service.Corrected claims must also be submitted within 120 days post-date-of-service. Adopting a uniform set of 180 Days from Initial Claims or if its secondary 60 Days from Primary EOB: BCBS COVERKIDS: 120 Days: BCBS Florida timely filing: 12.Claims where EmblemHealth is the secondary payer must be received within 120 days from the primary carrier’s explanation of payment (EOP) date.

This timely filing is for FFS claims submissions and not related to performance. The timely filing limit varies by insurance company and typically ranges from 90 to 180 days. Unless otherwise specified by the applicable participation agreement: Blue Shield of California Promise Health Plan invites you to join us for. For institutional claims, the timely filing period begins as of the DOS listed in the Through field of the Statement Covers Period of the UB-04. Follow the list and Avoid Tfl denial.Timely filing requirements for medical/hospital claim submissions*: TimelyFiling Procedures The Plan claims must be submitted within 180 days of the date of service (DOS). One such important list is here, Below list is the common Tfl list updated 2022. The time limit starts from the date of service, when the medical procedure was performed, and ends on. There is a lot of insurance that follows different time frames for claim submission. Timely filing limit refers to the maximum time period an insurance company allows its policyholders, healthcare providers and medical billing companies to submit claims after a healthcare service has been rendered. One of the common and popular denials is passed the timely filing limit.

0 kommentar(er)

0 kommentar(er)